- The Retention Edge by MobiLoud

- Posts

- 5 Growth Levers Most DTC Brands Ignore

5 Growth Levers Most DTC Brands Ignore

These effective growth channels are hiding in plain sight, masquerading as cost centers.

Paid ads, email, SMS. That’s where most brands instinctively look for growth. Write bigger checks to Meta, send more campaigns, hope the numbers shake out.

But too few brands consider the big levers sitting elsewhere in your business — often masquerading as cost centers.

Customer service. Fulfillment. Merchandising. Even the way you handle a post-purchase tracking email.

Seen through the right lens, these are potential growth levers, not back-office functions or cost centers.

And if you can engineer them intentionally, they’ll do two things ads rarely can:

Create margin that funds future bets.

Build brand equity that compounds over time.

So instead of obsessing over the next paid hack, zoom out. Here are five hidden growth centers that you can, and should leverage to scale your business the right way.

1. Customer Service & CX

Most business owners still think of support as a necessary evil. It’s a cost center, a line item to keep as lean as possible.

For me, that’s one of the biggest mistakes in business.

Treat support as offense, not defense.

Every customer interaction is an opportunity to drive future sales.

A great experience builds loyalty and future purchase intent.

A bad one drives churn and fuels negative word of mouth.

And importantly, support hears objections at scale, objections that your ads, PDPs, and product pages should be addressing.

Growth doesn’t have to mean bringing in more customers. It can mean reducing customer churn, or increasing repeat purchase rate.

And a great customer experience can lead to acquisition as well, helping you refine your messaging and driving Word of Mouth, which is where real, explosive growth sits.

2. Post-Purchase Experience

It’s not just the buying experience that matters, but what comes after you close the sale.

Unboxing

Order updates

Onboarding (content that helps customers get value out of their product)

These are great opportunities to build emotional highs that resonate, and feed into repeat purchases and customer advocacy.

Crucially, they’re also natural touchpoints, chances to cement your brand in their mind.

Apple has mastered this: packaging and a kind of onboarding experience that lets you know that you just bought a premium product, and sticks with you long after your purchase.

Many products arrive quietly. They do their job, but the customer has no recollection of the brand.

You don’t want to be like that. You want to be memorable.

3. Fulfillment & Inventory Management

This is one of those areas operators don’t think of as “growth” — but it absolutely is.

Fulfillment and inventory impact revenue in two big ways:

Customer-facing

If products show up late, damaged, or out of stock, you lose trust.

If they arrive on time, in good condition, every time — you build reliability.

Reliability = repeat purchases. And repeat purchases are where your profit actually comes from.

Behind the scenes

A finely tuned supply chain means fewer stockouts, less capital tied up in dead inventory, and better margins overall.

More margin means more cash flow. And more cash flow means you can fund the bets that do accelerate growth.

Amazon built a trillion-dollar empire not just on Prime ads, but on the promise of fast, reliable delivery. That reliability is the growth engine.

As Omer Hazer shared on our podcast, when supply chain issues led to stockouts, customers don’t wait around — they look somewhere else to get what they want.

You obsess over ad creative, but ignore the fact that an out-of-stock product kills sales faster than any bad ad campaign ever could.

Your brand needs to make (and keep) a promise to your customers: we’ll get you what you want, when you want it.

4. Merchandising

The best brands don’t launch a random product catalog and hope ads will make it work. They design their lineup with growth in mind.

That means building a catalog that naturally drives repeat purchases and keeps customers engaged.

Consumables: products that run out and need to be reordered.

Complements: products that play well together, nudging bundles and higher AOV.

Seasonal drops: limited-time products that create excitement and bring existing customers back.

The Pumpkin Spice Latte is the perfect example. Starbucks turned a simple seasonal drink into a cultural ritual. Every fall, the PSL brings customers flooding back in — not because they forgot about Starbucks, but because the product itself created its own moment.

And this isn’t just coffee chains. Mack Weldon, for example, leans on bundles and packs to encourage repeat purchase and drive AOV. Their design team builds catalogs around consistency and storytelling — so customers always feel oriented, and it makes repeat purchases easy.

That’s the point: merchandising done right isn’t random. It’s intentional. It’s how you make sure there’s always a next purchase waiting for your customer.

5. Community

Humans are wired for belonging. Make your customers feel like they’re part of a tribe, and your brand starts to become something much more than just a collection of products.

That shift changes the economics in your favor:

Lowers CAC — people discover you through friends, not just ads.

Raises price tolerance — fans pay more when they feel aligned with the mission.

Generates UGC at scale — reviews, TikToks, Instagram posts — all of which boost conversion more than any branded claim ever could.

Community can come in different forms. It can be a real community (Facebook group, Discord channel, Reddit). Or it could come from your social presence, making customers feel like they’re in on the joke, or part of the movement.

It could be from your app, and regular push notifications that make your brand feel like part of the customer’s life.

When you build a real sense of community and belonging, this becomes one of the most powerful moats a brand can have.

Next Steps

Growth isn’t just how much money you can throw at ads, or how many emails you send.

Just about every part of your business can be seen through the lens of growth. And that’s how successful, resilient brands are built.

These growth centers are opportunities to escape the handcuff of paid acquisition. It’s how brands start to grow organically, not on a curve that’s fixed to your ad spend.

So, I hope you go away and do this: start thinking about your business from a growth perspective: “What would this look like if it was a growth center, not a cost center?”

Paid drives attention. These five growth centers are how you keep it, compound it, and turn it into something no algorithm can take away.

FYI: Want a zero-maintenance way to boost post-purchase touchpoints, community, and CX on mobile? Get a free app preview and see how push + native apps can help you drive real growth this year.

Quick Hits

What’s Next for DTC?

It’s an interesting time right now for ecom (especially DTC). It feels like we’re on the other side of a major boom, and with AI-native shopping looming, the future looks unpredictable.

This piece from Retail Brew does a great job of breaking it down, and shares what some DTC leaders are thinking and where the industry could be headed in the near future.

AI & DTC

On AI, the DTC Newsletter & Triple Whale just put out a report featuring survey responses from 875 operators on how they’re using AI, their main concerns or blockers, outlook for the future, and more.

A few takeaways:

93% of DTC marketers are using AI in some way (most often for creative tasks)

There’s still some lack of trust blocking adoption, as well as quality concerns.

83% of marketers are using AI to save time.

84% expect their AI usage to grow — but as a team enhancer, not a job replacer.

Worth a read if you’re working on integrating AI for more things in your biz.

Gen AI Traffic up 4,700%

More and more shoppers are finding things to buy through AI, and the data backs it up.

Adobe data shows that ecommerce traffic from AI was up 4,700% in July. Worth noting that this is a Year on Year increase — so we’re probably comparing it to a rather small share in July 2024.

But it’s still some evidence of the growing adoption of AI search, and the importance of showing up in places like Chat GPT.

Ecom Returns to Its COVID Peak

Ecommerce now makes up 16.3% of total retail sales in the US.

That number is notable for one key reason: it’s the same peak ecom hit in Q2, 2020, at the height of COVID lockdowns.

The report on Marketplace Pulse gives a good look at the industry’s growth over the past few years. And while ecom’s growth is up and down (2024’s growth was a bit less than the number from 2023), it’s consistently growing at a faster pace than non-ecom retail — a good sign for online brands.

Amazon Blocks AI Bots

Interestingly, Amazon has been making efforts to block AI crawlers from accessing their site, using their content as training data, and making autonomous purchases.

It will be interesting to see how this stance evolves as AI shopping does, as Amazon could end up shooting themselves in the foot if this results in fewer recommendations and less traffic to the site.

Shopify Upgrading Shipping Product

Just quietly, Shopify has been building out and improving their fulfillment network.

They’re adding more major partners, and adding tools to improve speeds, lower costs, and beef up accuracy.

We’ve already mentioned the importance of fulfillment in this edition. Just another reason more and more brands are migrating towards Shopify.

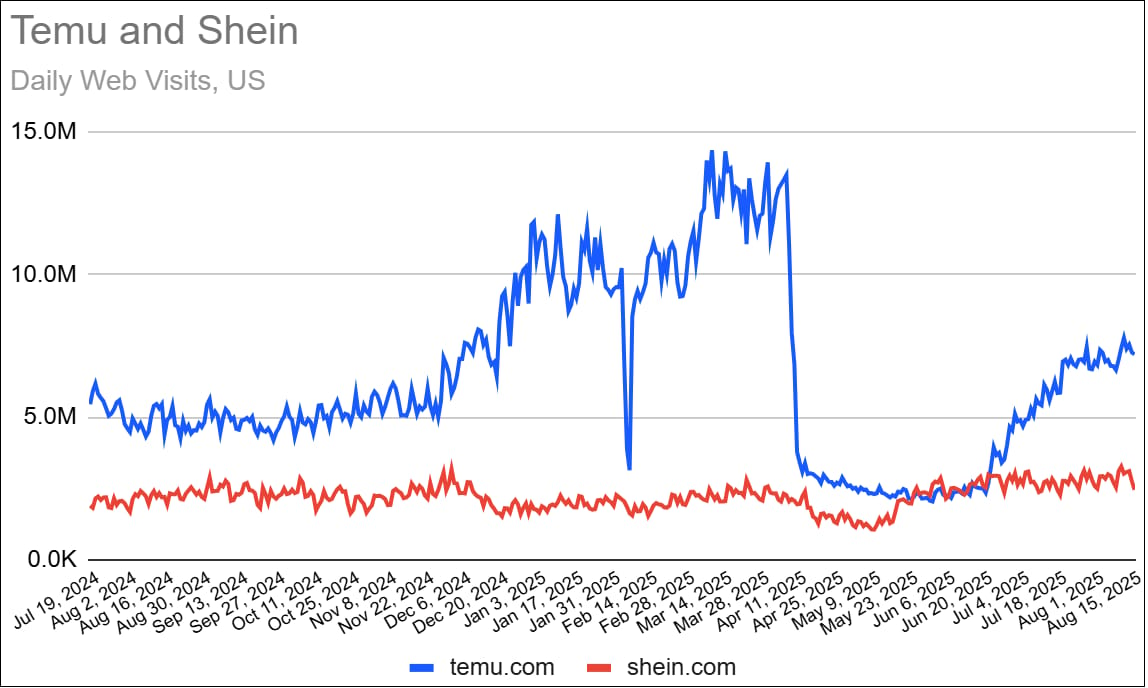

Temu’s Traffic Drop

We already know about the impact 2025 has had on Temu; de minimis and tariffs gutted the brand, which was built on hacks that allowed them to offer millions of products at dirt-cheap prices.

Now we’ve got an idea of just how big that impact has been.

US web visits cratered in April, dropping from 13 million to 3 million. Active users on their app fell from a little over 15 million to less than 10 million.

Interestingly, Shein hasn’t been affected close to the same degree. While their traffic dipped a bit around April, it’s been rebounding since, and they’re actually in a better spot (both organic traffic and app installs) than a year ago.

Shein’s UK Revenue Up 32%

On Shein — they’re making a very successful push in the global market. UK revenue is pointing up, crossing 2 billion pounds (over 2.3 billion euro) in 2024, based on recently released financials.

The company is also growing strongly in markets like France and Germany, and is outpacing competing fast-fashion brands like ASOS and Boohoo.

That’s all for now.

I’ll be back in touch next week, with more on how successful brands are doing CX and retention right.

If there’s any topic you’d like to see us dive into, for either the newsletter or the podcast, just shoot me a message here.

Until next time,

Pietro and The Retention Edge Team

PS: want to boost retention, revenue and profitability? If so, launching your own app could be the best move you make this year.

See how: go to our website to get a preview of your app for free, or shoot me a DM on LinkedIn to talk about it.